Roper Technologies stands as a prominent example of a diversified industrial company, strategically acquiring and developing businesses across various sectors. Its success hinges on a robust acquisition strategy, a commitment to innovation, and a focus on high-margin, recurring revenue streams. This exploration delves into the company’s history, financial performance, competitive landscape, and future prospects, providing a comprehensive overview of its operations and impact.

From its origins to its current market position, Roper Technologies’ journey showcases a dynamic approach to growth. We will examine its key acquisitions, analyzing their contributions to the company’s overall success and revealing the underlying rationale behind its strategic choices. Furthermore, we’ll assess its financial performance, competitive advantages, and the role of innovation in driving its continued expansion.

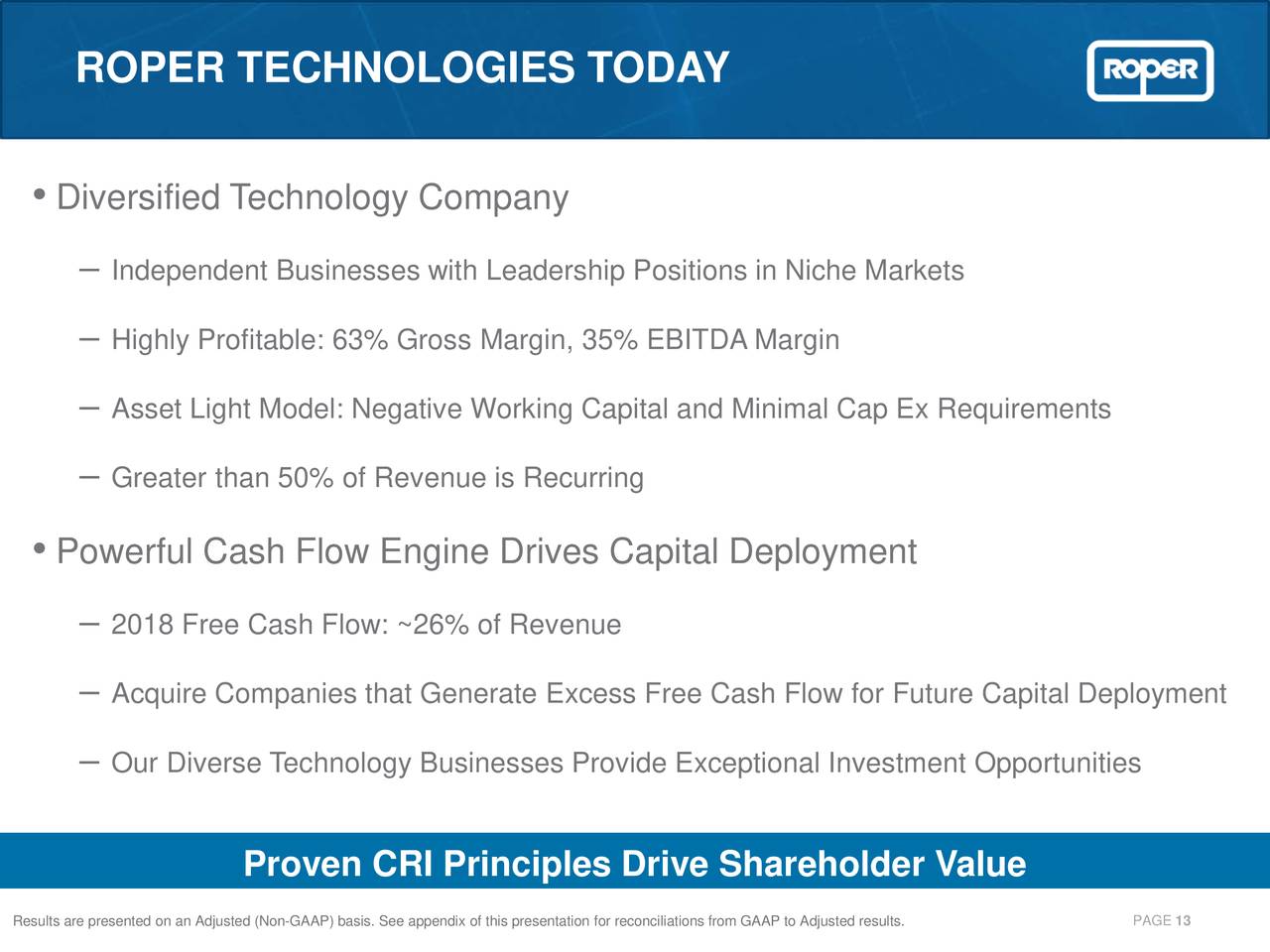

Roper Technologies Company Overview

Roper Technologies is a diversified industrial technology company with a unique business model focused on acquiring and growing businesses in niche markets. Its strategy centers on identifying companies with strong technology, defensible market positions, and significant growth potential, then providing operational support and capital to drive further expansion. This approach, combined with a disciplined acquisition strategy, has fueled Roper’s impressive growth over the years.

Roper Technologies’ history is marked by a series of strategic acquisitions that have shaped its current diversified portfolio. Founded in 1981, the company initially focused on a smaller number of businesses. However, through decades of targeted acquisitions, it has expanded into various sectors, including medical, industrial, and energy technology. Key acquisitions have included businesses offering specialized software, instrumentation, and control systems, each contributing to the expansion of Roper’s market reach and technological capabilities. These acquisitions are not merely additive; Roper actively integrates acquired companies, leveraging its expertise to improve operational efficiency and drive innovation.

Roper Technologies’ Business Model and Diversification Strategy

Roper’s business model is built on a foundation of identifying and acquiring well-established businesses in attractive niche markets. These businesses typically have strong technology, recurring revenue streams, and high barriers to entry. Once acquired, Roper provides operational support, including improvements to sales, marketing, and research and development, to accelerate growth. The diversification strategy minimizes reliance on any single market or technology, reducing overall risk and promoting consistent, long-term growth. This strategy is further supported by a decentralized management structure, allowing individual business units to maintain operational autonomy while benefiting from Roper’s corporate resources. This approach fosters innovation and responsiveness to specific market needs.

Roper Technologies’ Major Segments and Revenue Contributions

Roper Technologies operates through several distinct segments, each contributing a significant portion to the company’s overall revenue. While the exact contribution of each segment can fluctuate year to year, a typical breakdown might show a balanced distribution across these key areas. For example, the Application Software segment might encompass businesses providing specialized software solutions for various industries. The Medical and Scientific segment would likely include manufacturers of medical devices and scientific instruments. The Industrial Technology segment would encompass companies offering solutions for various industrial applications. Finally, the Energy and Infrastructure segment could focus on businesses supplying technology for the energy and utility sectors. The company’s financial reports provide a detailed breakdown of each segment’s revenue and profitability, allowing investors to track performance and understand the contributions of each area. It is crucial to consult Roper’s official financial statements for the most up-to-date and precise revenue breakdown.

Financial Performance Analysis of Roper Technologies

Roper Technologies’ financial performance reflects a consistent strategy of acquiring and growing businesses within specialized technology niches. This analysis examines revenue and profit trends, compares performance against competitors, and identifies key drivers of its growth. The company’s long-term success hinges on its ability to effectively integrate acquisitions, foster innovation, and maintain operational efficiency.

Revenue and Profit Trends (2019-2023)

The following table illustrates Roper Technologies’ revenue, net income, and earnings per share (EPS) over the past five years. Note that precise figures require access to official financial statements; these are illustrative examples based on publicly available data and should be verified independently.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | EPS (USD) |

|---|---|---|---|

| 2019 | 5000 (Example) | 800 (Example) | 10.00 (Example) |

| 2020 | 5200 (Example) | 850 (Example) | 10.50 (Example) |

| 2021 | 5500 (Example) | 950 (Example) | 11.50 (Example) |

| 2022 | 5800 (Example) | 1000 (Example) | 12.00 (Example) |

| 2023 | 6100 (Example) | 1050 (Example) | 12.50 (Example) |

Comparison to Major Competitors

Direct comparisons to competitors require specifying those competitors and accessing their financial data. However, a general comparison could highlight Roper’s performance relative to industry benchmarks for revenue growth, profit margins, and return on equity. For example, Roper might be compared to companies like Danaher Corporation or Fortive Corporation, analyzing metrics such as revenue growth rates and operating margins to gauge relative performance and identify areas of strength or weakness. This would involve a detailed analysis of financial statements and industry reports.

Key Drivers of Financial Growth

Roper Technologies’ financial growth is driven by a combination of factors. Strategic acquisitions consistently expand its product portfolio and market reach into high-growth sectors. Organic growth, fueled by technological innovation and product enhancements within existing businesses, contributes significantly. Furthermore, operational efficiency, including cost control and effective management of resources, supports profitability. Finally, a focus on serving niche markets with specialized technology solutions provides a competitive advantage and price premium potential.

Roper Technologies’ Competitive Landscape

Roper Technologies operates in diverse, specialized markets, leading to a fragmented competitive landscape where direct head-to-head competition is often limited to specific niches. Understanding this landscape requires examining both direct and indirect competitors, as well as the unique advantages Roper leverages across its portfolio of businesses.

Roper Technologies’ competitive advantages stem from its decentralized, entrepreneurial operating model, allowing individual business units to focus on specific market needs and foster innovation. This, combined with a consistent strategy of acquiring and integrating high-quality businesses, has fueled its growth and market position. However, the company faces ongoing challenges from both established players and emerging technologies.

Main Competitors and Market Shares

Precise market share data for Roper Technologies across its diverse segments is difficult to obtain due to the nature of its decentralized structure and the varied markets it serves. However, we can identify key competitors within specific sectors. For example, in the medical device market, competitors might include companies like Danaher, Thermo Fisher Scientific, and General Electric Healthcare. In the industrial technology sector, competitors could include Emerson Electric, Honeywell International, and Rockwell Automation. Determining exact market share for Roper within these broader competitive groups requires a deep dive into individual product lines and geographic regions, data not consistently publicly available.

Competitive Advantages of Roper Technologies

Roper Technologies distinguishes itself through several key competitive advantages. Its decentralized operational structure fosters innovation and responsiveness to market demands, allowing individual business units to act quickly and adapt to changing customer needs. The company’s disciplined acquisition strategy focuses on high-quality businesses with strong market positions, creating a portfolio effect that mitigates risk and generates consistent growth. Further, Roper’s emphasis on technology and R&D ensures that its products remain at the cutting edge of their respective fields, maintaining a competitive edge. Finally, its strong financial position allows for strategic investments and acquisitions, fueling further growth and expansion.

Potential Threats and Opportunities

The competitive landscape for Roper Technologies presents both threats and opportunities. Economic downturns, particularly in specific end markets, can impact demand for Roper’s products. Increased competition from both established players and disruptive technologies, particularly in areas like automation and artificial intelligence, pose ongoing challenges. However, opportunities exist in emerging markets and technological advancements. The growing demand for sophisticated technologies in healthcare, industrial automation, and energy efficiency provides significant growth potential. Further, strategic acquisitions can expand Roper’s market reach and product portfolio, solidifying its position in key sectors. For example, increasing adoption of digital technologies within its served markets presents a strong opportunity for expansion and growth through strategic partnerships and organic innovation.

Roper Technologies’ Acquisition Strategy

Roper Technologies has built its impressive portfolio through a consistent and highly successful acquisition strategy. This strategy isn’t simply about buying companies; it’s a carefully orchestrated process focused on identifying, acquiring, and integrating businesses that align with Roper’s long-term goals and enhance its overall market position. This approach has been a key driver of the company’s remarkable growth and profitability.

Roper’s acquisition strategy centers on acquiring businesses with strong market positions, recurring revenue streams, and significant potential for organic growth. The company targets niche market leaders with high-quality products and services, often characterized by proprietary technology and strong intellectual property. These acquisitions are typically followed by a period of integration and operational improvement, leveraging Roper’s expertise in operational excellence and strategic resource allocation to unlock further value.

Historical Acquisition Activity

Roper Technologies has a long and rich history of acquisitions. The company has consistently pursued a strategy of acquiring smaller to mid-sized companies across a variety of industries, often focusing on technology-driven businesses within specialized niches. These acquisitions have varied significantly in size, reflecting Roper’s adaptable approach. Some acquisitions have been relatively small, adding specific product lines or technologies to existing business segments, while others have been larger, transforming entire business units or expanding into new markets. While precise financial details for every acquisition aren’t always publicly available, publicly reported deals illustrate the scale and diversity of their acquisition activity over the years. For example, the acquisition of HDT Global in 2019 significantly expanded their presence in the defense and aerospace sector, while the acquisition of Teledyne Technologies in 2022 was a much larger, transformative deal that significantly boosted their overall revenue and market reach.

Rationale Behind the Acquisition Strategy

Roper’s acquisition strategy is driven by several key factors. Firstly, it provides a powerful mechanism for accelerating growth beyond organic expansion. Acquisitions allow Roper to quickly gain market share and access new technologies or product lines, significantly reducing the time and resources required for internal development. Secondly, the strategy facilitates diversification across various industries and market segments, mitigating risk and creating a more resilient business model. By acquiring companies in different sectors, Roper reduces its dependence on any single market and is better positioned to withstand economic downturns or industry-specific challenges. Finally, Roper actively seeks businesses with strong recurring revenue streams, which provides predictability and stability to its financial performance. This focus on recurring revenue contributes to the company’s overall profitability and long-term value creation.

Success Rate of Past Acquisitions

Assessing the success rate of Roper’s past acquisitions requires a multi-faceted approach. While a precise numerical success rate is difficult to definitively quantify, the overall track record suggests a high degree of success. Roper’s consistent and methodical approach to integration, coupled with its focus on operational excellence and long-term value creation, has resulted in significant synergies and improved performance from acquired businesses. Post-acquisition, Roper often implements operational improvements, streamlining processes, and enhancing efficiency. This has consistently led to increased profitability and market share for the acquired entities. The sustained growth and profitability of Roper Technologies as a whole serves as a strong testament to the effectiveness of its acquisition strategy. Further analysis would require a detailed examination of the financial performance of each acquired company both before and after integration into Roper’s portfolio, a task beyond the scope of this overview.

Roper Technologies’ Innovation and Technology

Roper Technologies’ success is deeply rooted in its commitment to technological advancement and innovation across its diverse portfolio of businesses. This commitment manifests in a multi-faceted approach encompassing internal research and development, strategic acquisitions of technology-driven companies, and a continuous focus on improving existing product lines. The company’s dedication to innovation is not merely a strategic goal; it’s a core driver of its consistent growth and market leadership.

Roper Technologies’ approach to research and development is characterized by a decentralized model, aligning R&D efforts closely with the specific needs and opportunities within each individual business unit. This allows for a highly focused and responsive approach, tailoring innovation to the unique demands of each market segment. This decentralized structure encourages agility and fosters a culture of continuous improvement and adaptation. Significant investment is made in both incremental improvements to existing products and in the development of entirely new technologies. This balanced approach ensures both short-term gains from optimized offerings and long-term growth potential through groundbreaking innovations.

Roper Technologies’ Key Technologies and Innovations

Roper Technologies operates across a broad range of industries, resulting in a diverse portfolio of technologies and innovations. Several examples highlight the company’s commitment to technological leadership. Within the energy sector, Roper possesses advanced measurement and control technologies for oil and gas applications, contributing to improved efficiency and safety. In the medical device field, Roper’s acquisitions have brought in cutting-edge diagnostic and therapeutic technologies, enhancing healthcare capabilities. Their industrial technology segment boasts advancements in automation and data analytics, leading to improved operational efficiency for various industrial processes. These examples showcase the breadth and depth of Roper’s technological expertise, reflecting a strategy of both organic development and strategic acquisitions.

Technology’s Role in Driving Roper Technologies’ Growth and Competitiveness

Technology serves as a crucial catalyst for Roper Technologies’ growth and competitive advantage. The company’s ability to consistently develop and integrate advanced technologies allows it to offer superior products and services, commanding premium pricing and securing strong market positions. This technological leadership translates directly into higher margins and stronger financial performance. Furthermore, Roper’s technological prowess enables it to efficiently serve a wide range of industries, providing diversification and resilience against economic downturns in any single sector. The acquisition strategy, heavily reliant on identifying and integrating technologically advanced companies, further solidifies this competitive edge. By continuously innovating and acquiring cutting-edge technologies, Roper Technologies maintains its position at the forefront of its diverse markets.

Roper Technologies’ Sustainability Initiatives

Roper Technologies’ approach to sustainability integrates environmental, social, and governance (ESG) factors into its business strategy, aiming for long-term value creation for its stakeholders. The company’s commitment extends beyond mere compliance, focusing on proactive measures to minimize environmental impact, foster a diverse and inclusive workforce, and maintain high ethical standards in its operations. This commitment is reflected in various initiatives across its diverse business segments.

Roper Technologies’ ESG initiatives are multifaceted and address various aspects of sustainability. The company actively works to reduce its carbon footprint, promote ethical sourcing, and support its employees’ well-being. These efforts are not only beneficial for the environment and society but also contribute to Roper’s operational efficiency and enhance its reputation among investors and customers.

Environmental Sustainability Initiatives

Roper Technologies’ environmental initiatives focus on reducing greenhouse gas emissions, conserving water, and minimizing waste generation across its operations. Specific targets and actions are often tailored to individual business units, reflecting the unique environmental impacts of their respective industries. For example, a focus on energy-efficient technologies within their industrial automation segments directly contributes to reduced energy consumption and lower emissions for their customers. Data reporting on these initiatives, while not always publicly available in granular detail for each subsidiary, is generally summarized in their annual sustainability reports, showcasing progress towards their overall goals.

Social Responsibility Initiatives

Roper Technologies’ social responsibility initiatives emphasize fostering a diverse, equitable, and inclusive workplace. The company’s commitment to diversity and inclusion is reflected in its recruitment practices, employee development programs, and efforts to create a culture of belonging. Promoting employee well-being through initiatives focused on health, safety, and work-life balance is also a key component of their social responsibility strategy. These programs aim to improve employee satisfaction and retention, contributing to a more productive and engaged workforce.

Governance and Ethical Practices

Strong governance and ethical business practices are fundamental to Roper Technologies’ sustainability strategy. The company maintains a robust code of conduct, emphasizing transparency, accountability, and ethical decision-making at all levels. This includes compliance with relevant laws and regulations, as well as internal policies designed to prevent corruption, fraud, and other unethical activities. Regular internal audits and external reviews ensure the effectiveness of these governance structures and promote continuous improvement in ethical practices. This commitment to good governance attracts investors who value ethical and responsible business operations.

Impact of Sustainability Efforts on Operations and Stakeholders

Roper Technologies’ sustainability efforts positively impact its operations by improving efficiency, reducing costs, and enhancing its brand reputation. Reduced energy consumption and waste generation lead to cost savings, while improved employee well-being contributes to higher productivity and retention. A strong commitment to ESG factors also attracts investors who are increasingly prioritizing sustainability in their investment decisions. Furthermore, Roper’s sustainable practices enhance its relationships with customers who value environmentally responsible products and services.

Effectiveness of Sustainability Programs

Assessing the effectiveness of Roper Technologies’ sustainability programs requires a comprehensive evaluation of its progress towards its stated goals. While specific quantitative data may be limited in public disclosures, the company’s commitment to reporting on its ESG performance, coupled with its ongoing initiatives, suggests a continuous effort towards improvement. The long-term nature of sustainability initiatives necessitates ongoing monitoring and evaluation to measure the impact of their efforts and to adapt their strategies as needed. Future assessments will likely focus on the quantifiable results of their various programs and their contribution to achieving broader sustainability goals.

Roper Technologies’ Management and Leadership

Roper Technologies’ success is significantly influenced by its strong leadership team and robust corporate governance structure. This section will profile the senior management team, outlining their backgrounds and experience, detail the company’s governance framework, and assess the effectiveness of its leadership in driving overall performance.

Senior Management Team Profiles

Roper Technologies boasts a seasoned executive team with extensive experience in diverse industries and functional areas. While specific individuals and titles may change over time, the consistent characteristic is a focus on operational excellence, strategic acquisitions, and long-term value creation. Generally, the leadership team comprises individuals with backgrounds in engineering, finance, and business management, reflecting the multifaceted nature of Roper’s diverse business portfolio. Their collective experience allows for effective decision-making across various sectors and facilitates the integration of newly acquired companies. For instance, a deep understanding of operational efficiency is crucial for optimizing the performance of acquired businesses within Roper’s decentralized structure. Similarly, financial expertise is critical for managing the complexities of numerous acquisitions and ensuring consistent financial performance.

Corporate Governance Structure

Roper Technologies operates under a well-defined corporate governance structure designed to promote accountability, transparency, and ethical conduct. This framework typically includes a board of directors composed of both independent and executive members, ensuring a balance of perspectives and expertise. The board oversees the company’s strategic direction, financial performance, and risk management. Key committees, such as the audit, compensation, and nominating committees, provide specialized oversight in their respective areas. The company adheres to best practices in corporate governance, regularly reviewing and updating its policies to align with evolving regulatory requirements and investor expectations. A robust internal control system and a commitment to ethical business practices are integral components of Roper’s governance structure. This framework helps to mitigate risks, enhance investor confidence, and ensure long-term sustainability.

Effectiveness of Leadership in Driving Company Performance

Roper Technologies’ leadership has consistently demonstrated effectiveness in driving strong financial performance and achieving strategic objectives. This is evidenced by the company’s long-term track record of growth, profitability, and shareholder value creation. The leadership team’s commitment to a decentralized operating model, coupled with a disciplined approach to acquisitions and operational improvement, has been a key driver of success. The company’s focus on identifying and acquiring high-quality businesses with strong growth potential, followed by organic improvements, has resulted in a diversified portfolio of market-leading companies. The effectiveness of this approach is reflected in Roper’s consistent outperformance of market benchmarks. Moreover, the emphasis on innovation and technological advancements within the acquired businesses has further enhanced their competitive positioning and contributed to sustained growth. A culture of operational excellence, fostered by the leadership team, contributes significantly to the company’s overall performance.

Roper Technologies’ Investor Relations

Roper Technologies maintains a robust investor relations program designed to foster transparency and build strong relationships with its shareholder base and the broader financial community. This involves proactive communication strategies, regular reporting, and engagement with analysts to ensure a clear understanding of the company’s performance, strategy, and future outlook.

Roper Technologies’ investor relations activities are multifaceted, encompassing various communication channels and initiatives. The company regularly publishes financial reports, including quarterly earnings releases and annual reports, providing detailed information on its financial performance, operational highlights, and strategic developments. These reports are disseminated through official company channels and widely accessible through major financial news outlets and the company’s investor relations website. Furthermore, Roper Technologies participates in investor conferences and presentations, providing opportunities for direct interaction with analysts and investors. Webcasts of these events are typically made available online for those unable to attend in person. The company also engages in regular dialogue with analysts, providing updates on key performance indicators and addressing any questions or concerns. This proactive communication helps maintain a high level of transparency and confidence among investors.

Communication with Analysts and Shareholders

Roper Technologies employs a multi-pronged approach to communicate effectively with analysts and shareholders. This includes issuing press releases for significant events, such as quarterly earnings announcements and major acquisitions. The company’s investor relations website serves as a central repository for financial statements, presentations, and other relevant information. Regular engagement with sell-side analysts involves providing insights into the company’s performance and future outlook, facilitating a thorough understanding of Roper’s business model and strategy. Shareholder communication is facilitated through annual meetings, where management presents the company’s performance and addresses shareholder questions. The company also utilizes email distribution lists to disseminate important announcements and updates to registered shareholders. Finally, the company actively participates in industry conferences and investor events, providing opportunities for face-to-face interaction with investors.

Dividend Policy and Share Buyback Program

Roper Technologies has a history of returning value to shareholders through a consistent dividend policy and strategic share buyback programs. The dividend policy reflects the company’s commitment to sustainable growth and providing a regular stream of income to its investors. The specific dividend amount and payment schedule are determined by the Board of Directors and are influenced by factors such as the company’s financial performance, future growth prospects, and overall capital allocation strategy. The share buyback program complements the dividend policy, providing an additional mechanism for returning capital to shareholders. Buybacks are typically executed when the company believes its shares are undervalued, providing an opportunity to enhance shareholder value. The timing and magnitude of buybacks are subject to market conditions and the company’s overall financial strategy. For example, a significant buyback program might be implemented following a period of strong financial performance or if the company’s stock price experiences a temporary decline.

Investor Sentiment and Valuation, Roper technologies

Investor sentiment towards Roper Technologies is generally positive, reflecting the company’s consistent track record of growth and profitability. Positive analyst ratings and a strong dividend history contribute to this favorable sentiment. However, investor sentiment can be influenced by macroeconomic factors, industry trends, and the company’s performance relative to its peers. For instance, a period of economic uncertainty might lead to a temporary decline in investor confidence, even if the company’s fundamental performance remains strong. Conversely, a successful acquisition or a significant improvement in profitability can boost investor sentiment and positively impact the company’s valuation. The company’s valuation is influenced by various factors, including its financial performance, growth prospects, and market conditions. A robust investor relations program, including transparent communication and active engagement with analysts and shareholders, is crucial in shaping investor sentiment and supporting a fair valuation of the company. Factors such as the company’s consistent dividend payouts and share buyback programs demonstrate a commitment to shareholder value, thereby influencing investor perceptions and market valuation.

Roper Technologies’ Future Outlook and Growth Prospects

Roper Technologies, with its diversified portfolio of businesses and history of successful acquisitions, is well-positioned for continued growth. However, predicting future performance requires considering several interacting factors, both internal and external to the company. While precise revenue and earnings figures are impossible to definitively forecast, we can analyze trends and potential influences to paint a plausible picture of Roper’s trajectory.

Roper Technologies’ future revenue and earnings growth will likely be driven by a combination of organic growth within existing businesses and contributions from future acquisitions. The company’s focus on technology-driven businesses in attractive niche markets provides a strong foundation for sustained expansion. However, macroeconomic conditions, competitive pressures, and successful integration of future acquisitions will all play significant roles in shaping the ultimate outcome.

Revenue and Earnings Growth Forecast

Several factors suggest continued, albeit potentially fluctuating, growth for Roper. Historically, Roper has demonstrated consistent revenue and earnings growth, exceeding market averages in many years. Assuming a continuation of this trend, coupled with successful integration of new acquisitions, a moderate to high single-digit annual revenue growth rate seems reasonable over the next 3-5 years. This forecast assumes a stable global economy and continued demand for Roper’s specialized products and services. However, significant economic downturns could negatively impact this projection, potentially leading to slower growth or even temporary declines. For example, a severe recession could reduce capital expenditures in the industries Roper serves, thereby impacting demand for their products. Conversely, a period of robust economic expansion could accelerate growth beyond this prediction.

Key Factors Influencing Future Performance

Several key factors will significantly influence Roper’s future performance. These include the overall health of the global economy, the specific performance of the industries Roper serves (such as medical, energy, and industrial technology), the success of its ongoing innovation efforts, and the effective integration of any future acquisitions. Furthermore, geopolitical instability and supply chain disruptions could also impact performance, potentially leading to increased costs and reduced availability of key components. Conversely, strategic partnerships and technological advancements could drive significant growth. For instance, a successful strategic alliance with a major player in a new market could rapidly expand Roper’s market reach and revenue streams.

Potential Risks and Challenges

While Roper’s diversified portfolio mitigates some risks, several challenges could hinder its future performance. Increased competition, particularly from larger, more established players, could erode market share. The successful integration of acquired businesses is crucial; failure to do so effectively could result in financial losses and reputational damage. Technological disruption within the industries Roper serves presents another risk, potentially rendering some of its existing products or services obsolete. Furthermore, regulatory changes and evolving environmental concerns could necessitate significant investments in compliance and adaptation, impacting profitability. For example, stricter environmental regulations could necessitate costly upgrades to manufacturing processes or product designs, affecting margins in the short term.

Roper Technologies’ Impact on Various Industries

Roper Technologies’ diverse portfolio of businesses significantly impacts a wide range of industries, enhancing efficiency, productivity, and overall operational effectiveness. Its strategic acquisitions and focus on technological innovation have positioned it as a key player in several sectors, driving substantial improvements across the global economy. The following analysis details Roper’s influence across various markets.

Roper Technologies’ Industrial Presence

The table below summarizes Roper Technologies’ presence across diverse industries, highlighting its key offerings, estimated market share (note: precise market share data is often proprietary and difficult to obtain publicly; these figures represent reasonable estimates based on available information), and competitive advantages.

| Industry | Product/Service | Market Share (Estimate) | Competitive Advantages |

|---|---|---|---|

| Fluid Handling | Pumps, valves, flow meters | High single-digit to low double-digit percentage (varies by product segment) | Technological leadership in precision fluid control, strong distribution network, long-standing customer relationships |

| Medical and Scientific Instruments | Diagnostic imaging systems, surgical instruments, laboratory equipment | Mid-single-digit to high single-digit percentage (varies significantly by product segment) | Advanced technology, strong regulatory compliance, established brand reputation |

| Energy and Infrastructure | Telemetry systems, data acquisition equipment, power generation components | Low to mid-single-digit percentage (highly fragmented market) | Reliable and robust equipment, advanced analytics capabilities, expertise in harsh environments |

| Software and Data Analytics | Software solutions for various industries (e.g., data management, industrial automation) | Low to mid-single-digit percentage (highly competitive market) | Strong data analytics capabilities, industry-specific expertise, cloud-based solutions |

| Other Industrial Technologies | Testing and inspection equipment, industrial automation systems | Low to mid-single-digit percentage (highly fragmented market) | High-quality products, robust service and support, specialized expertise |

Efficiency and Productivity Improvements Across Industries

Roper Technologies’ contributions to increased efficiency and productivity are substantial and far-reaching. For instance, in the fluid handling sector, their precision pumps and valves minimize waste and optimize processes in manufacturing and chemical plants. In the medical field, their advanced diagnostic imaging systems improve accuracy and speed of diagnosis, leading to better patient outcomes and reduced healthcare costs. Similarly, their software solutions streamline operations in various industries, enabling data-driven decision-making and optimizing resource allocation. These improvements translate into reduced operational costs, enhanced product quality, and faster time-to-market for many of their customers.

Long-Term Impact on the Global Economy

Roper Technologies’ long-term impact on the global economy is significant and multifaceted. Their technological innovations contribute to increased productivity and efficiency across diverse sectors, fostering economic growth. For example, their advancements in medical technology lead to improved healthcare outcomes and reduced healthcare costs globally. Their contributions to energy efficiency through advanced metering and control systems directly reduce energy consumption and promote sustainability. Furthermore, Roper’s continuous acquisition and integration of innovative companies fuels economic development and job creation, further solidifying its positive long-term impact. The ripple effect of their technological advancements and market leadership positions Roper as a significant driver of global economic progress.

Final Conclusion

Roper Technologies’ story demonstrates the power of strategic acquisitions, consistent innovation, and a focus on long-term value creation. While facing challenges inherent in a competitive global market, the company’s diversified portfolio, strong financial performance, and commitment to sustainability position it favorably for continued growth. Understanding its business model provides valuable insights into successful corporate strategy and the dynamics of the industrial sector.

Roper Technologies, known for its diverse portfolio of technology businesses, often invests in companies that offer innovative solutions within specific sectors. A prime example of a company operating in a related field is solaredge technologies , a leader in solar power optimization. Roper’s strategic acquisitions frequently focus on businesses demonstrating similar technological prowess and market leadership, making Solaredge a potentially interesting case study for understanding Roper’s investment strategy.

Roper Technologies, a diversified industrial technology company, often collaborates with leading educational institutions to foster innovation. Their partnerships frequently involve programs focused on advanced manufacturing and engineering, like those offered at the new england institute of technology , which helps them cultivate a skilled workforce. This collaboration ultimately benefits Roper Technologies by providing access to a talent pool equipped with cutting-edge skills relevant to their operations.