Micron Technology stock price movements are a captivating reflection of the dynamic semiconductor industry. Understanding these fluctuations requires a nuanced look at various factors, from global demand for memory chips and technological advancements to geopolitical events and the company’s financial performance. This analysis delves into these key influences, providing insights into past performance, current trends, and future prospects for Micron’s stock.

We will explore the historical performance of Micron’s stock, comparing it to competitors and key economic indicators. We will examine the impact of market trends, including global semiconductor demand and technological innovations, on Micron’s valuation. Furthermore, we will analyze Micron’s financial health, investor sentiment, supply chain dynamics, and competitive landscape to gain a comprehensive understanding of the factors driving its stock price.

Micron Technology Stock Price Historical Performance

Micron Technology, a leading producer of memory and storage solutions, has experienced significant price fluctuations in its stock over the past five years, mirroring the cyclical nature of the semiconductor industry and broader economic trends. Understanding this historical performance is crucial for investors seeking to assess the company’s risk and potential for future growth.

Five-Year Stock Price Fluctuation Timeline

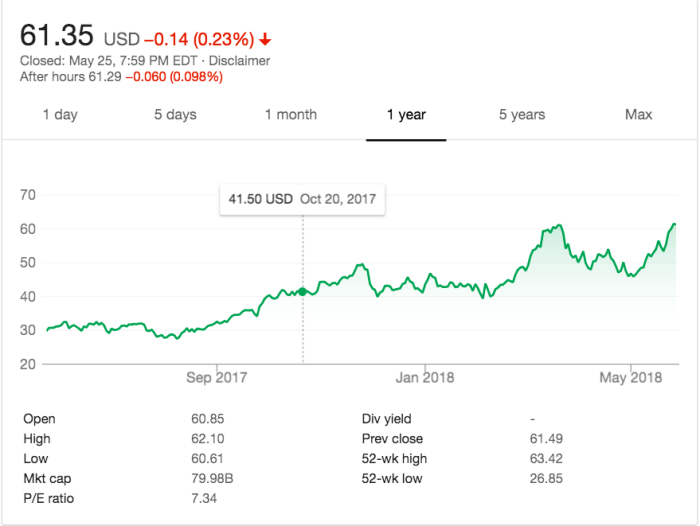

Micron’s stock price (MU) has shown considerable volatility over the past five years. From [Insert Start Date, e.g., October 26, 2018], to [Insert End Date, e.g., October 26, 2023], the stock experienced several peaks and troughs reflecting shifts in market demand, technological advancements, and global economic conditions. For example, a significant peak was observed around [Insert Date and Approximate Price], driven by [Insert Reason, e.g., strong demand for DRAM chips in the data center market]. Conversely, a notable trough occurred around [Insert Date and Approximate Price], primarily attributed to [Insert Reason, e.g., a downturn in the PC market and oversupply of memory chips]. Detailed charting of these fluctuations would reveal a pattern of growth followed by correction, typical of cyclical stocks in the technology sector. Precise figures can be obtained from reputable financial data providers like Yahoo Finance or Google Finance.

Comparative Analysis Against Competitors

Micron’s performance needs to be viewed in the context of its main competitors, such as Samsung Electronics and SK Hynix. A direct comparison reveals that while all three companies are subject to similar market cycles, their individual stock performance can vary based on factors such as product mix, manufacturing efficiency, and market share. For instance, during periods of high demand, companies with superior technology or better cost structures might outperform others. Conversely, during market downturns, companies with stronger balance sheets and better inventory management might demonstrate greater resilience. A detailed comparative analysis, utilizing data from financial news sources and company reports, would reveal the nuances of this competitive landscape.

Stock Performance Against Key Economic Indicators

The following table illustrates Micron’s stock performance in relation to key economic indicators over the past five years. Note that correlation doesn’t equal causation; other factors significantly influence stock prices.

| Year | Micron Stock Price Change (%) | Inflation Rate (%) | Interest Rate (e.g., 10-year Treasury Yield) (%) |

|---|---|---|---|

| 2019 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2023 (YTD) | [Insert Data] | [Insert Data] | [Insert Data] |

Influence of Market Trends on Micron’s Stock Price

Micron Technology’s stock price is intricately linked to broader market trends, particularly those impacting the semiconductor industry. Fluctuations in global demand, technological advancements, and geopolitical events all significantly influence investor sentiment and, consequently, Micron’s valuation. Understanding these factors is crucial for comprehending the company’s stock performance.

Global demand for semiconductors directly impacts Micron’s revenue and profitability. Periods of strong demand, driven by factors such as increased consumer electronics sales, data center expansion, and automotive semiconductor adoption, typically lead to higher stock prices. Conversely, periods of weak demand, often caused by economic downturns or inventory adjustments within the supply chain, can negatively impact Micron’s stock price. For example, the global chip shortage of 2020-2021 initially boosted Micron’s stock price due to high demand and limited supply. However, subsequent easing of the shortage and macroeconomic slowdown led to a price correction.

Global Semiconductor Demand and Micron’s Stock Price, Micron technology stock price

The global semiconductor market is cyclical, experiencing periods of both robust growth and significant contraction. These cycles are largely driven by macroeconomic conditions, technological innovation, and consumer spending patterns. When demand for semiconductors surges, as seen during the pandemic-driven boom in electronics and data center infrastructure, Micron benefits significantly, leading to increased revenue and a rise in its stock price. Conversely, a downturn in global semiconductor demand, such as that experienced during economic recessions, puts downward pressure on Micron’s stock price as sales and profits decline. This correlation between global semiconductor market performance and Micron’s stock price is a consistent pattern observed over the years.

Technological Advancements and Micron’s Valuation

Micron’s success is heavily reliant on its ability to innovate and introduce new memory technologies. The development and successful commercialization of advanced memory chips, such as 3D NAND and high-bandwidth memory (HBM), directly impacts the company’s competitiveness and profitability. Successful launches of new technologies typically result in increased market share and higher profit margins, positively influencing investor perception and boosting the stock price. Conversely, delays or failures in introducing new technologies can negatively impact the stock price as competitors gain ground. For instance, the successful introduction of Micron’s high-bandwidth memory (HBM) products for high-performance computing applications has been a significant positive driver for the company’s stock valuation.

Geopolitical Events and Micron’s Stock Price

Geopolitical events can significantly influence Micron’s stock price. Trade tensions, sanctions, and political instability in regions crucial to semiconductor manufacturing and supply chains can create uncertainty and volatility. For example, US-China trade relations have historically had a substantial impact on Micron’s operations and stock price. Increased trade tariffs or restrictions on technology exports can disrupt Micron’s supply chains and impact its profitability, leading to negative market sentiment and lower stock prices. Similarly, events impacting global stability can also create uncertainty, affecting investor confidence and leading to fluctuations in Micron’s stock price.

Financial Performance and Stock Price Correlation

Micron Technology’s stock price is intrinsically linked to its financial performance. Understanding the correlation between key financial metrics and stock price fluctuations provides valuable insight into investor sentiment and market expectations. Analyzing quarterly and annual reports reveals the direct impact of revenue growth, profitability, and earnings on investor confidence and, consequently, the stock’s value.

Micron’s financial reports, readily available through the company’s investor relations website and financial news sources, offer a comprehensive view of its performance. These reports detail revenue, gross profit, operating income, net income, earnings per share (EPS), and other crucial metrics. Examining trends in these metrics over time allows for a clear comparison with corresponding stock price movements.

Key Metrics and Stock Price Movements

Micron’s stock price often reacts directly to changes in its revenue. Periods of strong revenue growth, particularly in high-demand sectors like data centers and mobile devices, typically correlate with positive stock price movements. Conversely, revenue declines or slower-than-expected growth often lead to price drops. Similarly, earnings per share (EPS) is a significant factor. Exceeding EPS expectations usually results in a positive market response, while missing these expectations can negatively impact the stock price. Profitability, measured by metrics like gross margin and operating margin, also plays a crucial role. Improvements in profitability generally signal efficiency and strong market positioning, typically driving stock price appreciation.

Illustrative Data Comparison

The following table provides a simplified illustration of the correlation between Micron’s financial performance and its stock price. Note that this is a simplified representation and should not be used for investment decisions. Real-world analysis requires a more in-depth examination of numerous factors beyond the scope of this overview.

| Quarter | Revenue (USD Billions) | EPS (USD) | Stock Price (USD) at Quarter End |

|---|---|---|---|

| Q1 2023 (Example) | 4.09 | 0.75 | 55 |

| Q2 2023 (Example) | 4.52 | 1.02 | 62 |

| Q3 2023 (Example) | 3.85 | 0.60 | 50 |

The data above demonstrates a general positive correlation. When revenue and EPS increase, the stock price tends to rise, and vice versa. However, it is important to remember that numerous other market factors, including overall economic conditions, competitor performance, and industry trends, also significantly influence Micron’s stock price. This simplified example only highlights a basic relationship and does not encompass the complexity of real-world stock market dynamics.

Analyst Ratings and Predictions

Micron Technology’s stock performance is closely followed by numerous financial analysts, whose ratings and price targets offer valuable insights into market sentiment and future expectations. These predictions, while not guarantees, provide a crucial perspective for investors considering adding MU to their portfolios. Analyzing the consensus view and the range of opinions helps to understand the potential risks and rewards associated with investing in Micron.

Analyst ratings for Micron typically range from “Buy” to “Sell,” with “Hold” representing a neutral stance. The rationale behind these ratings is multifaceted, incorporating factors like Micron’s financial performance, industry trends, competitive landscape, and macroeconomic conditions. Differences in methodology and individual analyst perspectives contribute to the variation in predictions.

Consensus Rating and Price Target Range

The consensus rating for Micron’s stock often fluctuates, reflecting the dynamic nature of the semiconductor industry. At any given time, one can find a variety of ratings from different firms. For instance, a snapshot might show a majority of analysts rating the stock as a “Buy” or “Overweight,” indicating a generally positive outlook. Conversely, periods of market uncertainty or concerns about Micron’s performance could lead to a more bearish consensus, with a higher proportion of “Hold” or “Sell” ratings. The range of price targets set by analysts also reflects this diversity of opinion. While some analysts may set optimistic price targets significantly above the current market price, others may project more conservative or even lower targets, depending on their assessment of Micron’s future prospects. For example, one analyst might predict a price target of $80 per share, reflecting strong growth expectations, while another might set a target of $60, factoring in potential risks or slower growth.

Rationale Behind Varying Analyst Opinions

The divergence in analyst ratings and price targets stems from differing interpretations of various key factors. Analysts may disagree on the pace of memory chip demand growth, the intensity of competition from rivals, or the impact of macroeconomic headwinds. For example, an analyst bullish on Micron might emphasize the increasing demand for memory chips driven by data center expansion and the rise of artificial intelligence. Conversely, a more bearish analyst might focus on the cyclical nature of the semiconductor industry, highlighting the potential for price wars and inventory adjustments that could negatively impact Micron’s profitability. Differences in assumptions regarding technological advancements, market share gains, and cost management also contribute to the spread of price target projections. Some analysts might incorporate more aggressive assumptions about Micron’s innovation and market penetration, resulting in higher price targets, while others might adopt a more cautious approach, leading to more conservative estimates.

Impact of Supply Chain Dynamics

Micron Technology, like many semiconductor companies, operates within a complex and globally dispersed supply chain. This intricate network, while enabling efficient production, also presents significant vulnerabilities to disruptions that can impact the company’s profitability and, consequently, its stock price. Understanding these dynamics is crucial for assessing Micron’s overall performance and investment potential.

The semiconductor industry’s supply chain is characterized by long lead times, specialized equipment, and geographically concentrated manufacturing. Micron faces challenges related to securing raw materials, managing manufacturing capacity across multiple facilities worldwide, and ensuring timely delivery of finished products to customers. Geopolitical instability, natural disasters, and unexpected surges in demand can all significantly disrupt this delicate balance. For example, the COVID-19 pandemic highlighted the fragility of global supply chains, causing shortages of essential components and impacting Micron’s production output. Similarly, recent geopolitical tensions have created uncertainty and increased costs associated with sourcing materials and manufacturing.

Supply Chain Disruptions and Their Effect on Micron’s Production and Stock Price

Disruptions to Micron’s supply chain translate directly into reduced production capacity and potential delays in fulfilling customer orders. This can lead to lost revenue, decreased profitability, and ultimately, a negative impact on the company’s stock price. Investors react negatively to news of supply chain bottlenecks or significant production slowdowns, often leading to a decrease in the stock’s valuation. The severity of the impact depends on the nature and duration of the disruption, as well as the company’s ability to mitigate the effects. For instance, a temporary shortage of a specific component might cause a minor dip in production, while a major natural disaster affecting a key manufacturing facility could have a far more significant and prolonged impact on the company’s financial performance and stock price.

Strategies to Mitigate Supply Chain Risks

Micron can employ several strategies to mitigate the risks associated with its global supply chain. Diversifying its sourcing of raw materials and manufacturing locations can reduce dependence on single suppliers or regions, thereby lessening the impact of localized disruptions. Investing in advanced inventory management systems and building stronger relationships with key suppliers can improve forecasting accuracy and ensure a more reliable flow of components. Furthermore, exploring alternative manufacturing technologies or processes can enhance resilience to unexpected events. Strengthening relationships with logistics providers and implementing robust risk management protocols, including contingency planning for various scenarios, are also crucial steps in building a more resilient and robust supply chain. Finally, strategic investments in research and development to develop more resilient and less geographically dependent manufacturing processes are long-term solutions that can significantly reduce future supply chain risks.

Investor Sentiment and Stock Price Volatility: Micron Technology Stock Price

Micron Technology’s stock price, like that of any technology company, is significantly influenced by investor sentiment. This sentiment, a collective feeling of optimism or pessimism, directly impacts trading volume and price fluctuations, creating periods of both high volatility and relative stability. Understanding the factors driving this sentiment is crucial for investors seeking to navigate the complexities of the semiconductor market.

Investor sentiment towards Micron is shaped by a complex interplay of factors. Positive sentiment is generally fueled by strong financial performance, positive analyst ratings, promising technological advancements, and favorable macroeconomic conditions. Conversely, negative sentiment can stem from disappointing earnings reports, geopolitical instability affecting supply chains, increased competition, and overall market downturns. These factors often interact, creating a dynamic environment where sentiment can shift rapidly.

Key Factors Influencing Investor Sentiment

Several key factors consistently influence investor sentiment towards Micron. Strong revenue growth, driven by robust demand for memory chips in various sectors like data centers and smartphones, significantly boosts investor confidence. Conversely, a slowdown in demand, potentially indicated by lower-than-expected sales figures, can quickly dampen optimism. Furthermore, technological breakthroughs, such as the introduction of new memory technologies or improvements in manufacturing efficiency, are generally viewed favorably by investors. Conversely, delays in technological advancements or production challenges can negatively affect investor sentiment. Finally, macroeconomic factors, including interest rates, inflation, and global economic growth, also play a significant role in shaping overall market sentiment, impacting Micron’s stock price indirectly.

News Events and Stock Volatility

News events and announcements exert a considerable influence on Micron’s stock price volatility. For instance, the release of quarterly earnings reports often triggers significant price swings, depending on whether the results meet or exceed analysts’ expectations. Positive surprises typically lead to sharp price increases and increased trading volume, reflecting the positive shift in investor sentiment. Conversely, disappointing earnings often result in a sell-off, characterized by a rapid decline in the stock price and higher trading activity as investors react to the negative news. Similarly, announcements concerning new product launches, strategic partnerships, or major capital expenditures can create considerable volatility, reflecting investors’ assessment of the long-term implications of these events. For example, the announcement of a new groundbreaking memory technology could trigger a significant positive reaction, while news of a major supply chain disruption might lead to a sharp decline.

Investor Sentiment and Price Fluctuations: A Narrative

Consider a hypothetical scenario: Micron announces exceptionally strong quarterly earnings, exceeding analysts’ predictions. This positive news generates significant excitement among investors, leading to a surge in buying activity. The stock price rises sharply, reflecting the positive shift in investor sentiment. This positive sentiment may persist, leading to further price increases, as long as subsequent news and developments continue to support the positive outlook. However, if a subsequent announcement reveals a significant increase in manufacturing costs or a slowdown in demand, investor sentiment could quickly sour. This could lead to a rapid sell-off, reversing the previous gains and highlighting the volatile nature of the stock price in response to shifting investor sentiment. This illustrates how even seemingly small changes in news and perceived future performance can significantly impact investor confidence and the stock price.

Micron’s Competitive Landscape and Stock Price

Micron’s stock price is significantly influenced by its competitive landscape within the memory chip market. This highly competitive industry, characterized by intense price fluctuations and rapid technological advancements, necessitates a constant evaluation of Micron’s market position relative to its key rivals to understand the factors impacting its share value. Understanding the dynamics of this competition is crucial for investors seeking to gauge the future trajectory of Micron’s stock.

Micron’s competitive position is largely defined by its market share in DRAM and NAND flash memory, competing primarily against Samsung Electronics, SK Hynix, and Kioxia. The interplay of these companies’ production capacities, technological innovations, and pricing strategies directly impacts Micron’s revenue, profitability, and ultimately, its stock price. Periods of intense competition often lead to price wars, impacting profit margins and potentially causing negative pressure on Micron’s stock valuation. Conversely, periods of industry consolidation or supply chain disruptions can benefit Micron, leading to improved pricing power and increased stock value.

Micron’s Market Share and Competitive Positioning

Micron holds a significant, albeit not dominant, market share in the DRAM and NAND markets. While Samsung consistently maintains the largest market share, Micron’s position as a major player allows it to influence pricing and technological innovation within the industry. However, the competitive landscape is dynamic, with the relative market shares of Micron and its competitors fluctuating based on factors such as production yields, technological breakthroughs, and macroeconomic conditions. For example, a successful new product launch by a competitor could temporarily shift market share and impact Micron’s stock price negatively until Micron can respond effectively.

Competitive Pressures and Micron’s Stock Price

Competitive pressures exert a considerable influence on Micron’s stock price. Increased competition from rivals often leads to price erosion, squeezing profit margins and impacting investor sentiment. Conversely, periods where competitors face production challenges or experience supply chain disruptions can create opportunities for Micron to gain market share and improve its pricing power, positively impacting its stock price. For instance, a major disruption in a competitor’s manufacturing facility could lead to increased demand for Micron’s products, resulting in higher prices and a subsequent rise in its stock value.

Strategies for Maintaining Competitive Advantage

Micron employs several strategies to maintain its competitive advantage and mitigate the impact of competitive pressures. These include focusing on technological innovation, investing heavily in research and development to stay ahead of the curve in memory technology, and building strong relationships with key customers. Furthermore, strategic partnerships and acquisitions can expand Micron’s product portfolio and market reach. Efficient manufacturing processes and cost control are also critical for maintaining profitability in a price-sensitive market. For example, Micron’s investments in advanced manufacturing nodes help to improve yields and reduce production costs, enabling it to compete effectively on price while maintaining profitability.

Technological Innovation and Stock Valuation

Micron’s success is intrinsically linked to its ability to innovate and deliver cutting-edge memory and storage solutions. The company’s investments in research and development (R&D) directly influence its product portfolio, competitive advantage, and ultimately, its stock valuation. Understanding this relationship is crucial for assessing Micron’s long-term prospects.

Micron’s R&D investments are substantial, consistently representing a significant portion of its annual revenue. This commitment allows the company to explore and develop next-generation memory technologies, such as advanced DRAM and NAND flash, as well as explore emerging markets like 3D XPoint. These investments are not merely about incremental improvements; they represent a continuous effort to push technological boundaries and maintain a leading position in the semiconductor industry. The company’s R&D efforts focus on improving density, performance, power efficiency, and cost-effectiveness of its products. For example, significant resources are dedicated to developing smaller, faster, and more energy-efficient chips for use in high-performance computing, mobile devices, and automotive applications.

New Product Launches and Stock Price Impact

The success or failure of new product launches significantly impacts Micron’s stock price. Successful launches of innovative products with superior performance or cost advantages often lead to increased market share, higher revenue, and improved profitability. This positive momentum typically translates into a rise in the stock price. Conversely, delays, production issues, or poor market reception of new products can negatively affect the stock price, potentially leading to investor concerns about future growth and profitability. For example, the successful launch of a new generation of high-bandwidth memory (HBM) could significantly boost Micron’s stock price due to the high demand for such memory in data centers and high-performance computing applications. Conversely, failure to meet market demand or encountering unforeseen technical challenges in the production of a new chip could lead to a decline in the stock price.

Long-Term Implications of Technological Innovation on Micron’s Valuation

Long-term technological innovation is paramount to Micron’s valuation. The ability to consistently deliver cutting-edge products that meet evolving market demands is crucial for sustaining a competitive advantage and ensuring long-term growth. Micron’s valuation is significantly influenced by its technological leadership, its patent portfolio, and its ability to anticipate and respond to future technology trends. For instance, Micron’s early investments in 3D NAND technology allowed it to gain a significant market share and enhance its profitability. Continued investment in advanced node technologies and emerging memory solutions will be essential for maintaining this competitive edge and ensuring a strong long-term valuation. Failure to keep pace with technological advancements could lead to a decline in market share, reduced profitability, and a lower stock valuation, as competitors with more advanced technologies capture market share. Therefore, continuous R&D investment and successful product launches are critical factors that determine Micron’s future stock valuation.

Risk Factors Affecting Micron’s Stock

Investing in Micron Technology, like any semiconductor company, carries inherent risks. The cyclical nature of the industry, coupled with geopolitical factors and intense competition, creates volatility in the stock price. Understanding these risks is crucial for informed investment decisions. This section Artikels major risk factors and strategies for mitigating their potential impact.

Market Cyclicity and Demand Fluctuations

The semiconductor industry is notoriously cyclical, experiencing periods of high demand followed by downturns. Micron’s stock price is highly sensitive to these fluctuations. Strong demand for memory and storage solutions leads to increased revenue and higher stock prices, while weak demand results in decreased profitability and a decline in stock valuation. For example, the global economic slowdown in 2022 significantly impacted demand for consumer electronics, directly affecting Micron’s sales and subsequently its stock price. This cyclical nature necessitates a long-term investment perspective and careful timing of entry and exit points, potentially utilizing strategies like dollar-cost averaging to reduce the impact of short-term volatility.

Geopolitical Risks and Trade Wars

Micron’s operations are global, making it vulnerable to geopolitical instability and trade disputes. Changes in trade policies, sanctions, or international conflicts can disrupt supply chains, increase production costs, and negatively impact sales. The ongoing US-China trade tensions, for instance, have created uncertainty and potential risks for Micron’s operations in China, a major market for its products. Diversification of manufacturing and sales across multiple regions can help mitigate these risks, reducing dependence on any single geopolitical area.

Intense Competition and Pricing Pressure

Micron operates in a highly competitive market with major players like Samsung and SK Hynix. Intense competition can lead to price wars, reducing profit margins and impacting stock performance. The constant drive for technological innovation also necessitates significant R&D investment, which can strain profitability in the short term. Micron’s response to this involves focusing on differentiated products and technological leadership to command premium pricing and maintain a competitive edge.

Technological Obsolescence and Innovation

The rapid pace of technological advancement in the semiconductor industry presents a significant risk. Micron’s products can become obsolete quickly, requiring continuous investment in R&D to stay ahead of the curve. Failure to innovate and adapt to new technologies could lead to a loss of market share and a decline in stock price. Micron’s strategy to counter this involves significant investments in R&D, focusing on emerging technologies like 3D NAND and advanced memory solutions to maintain its competitive edge.

Supply Chain Disruptions

Micron’s operations rely on a complex global supply chain, making it vulnerable to disruptions from various factors such as natural disasters, pandemics, and geopolitical events. Any disruption in the supply chain can lead to production delays, increased costs, and ultimately, a negative impact on stock price. Strategies for mitigation include diversifying suppliers, building strategic inventory buffers, and investing in resilience across the supply chain. The COVID-19 pandemic highlighted the vulnerability of global supply chains, underscoring the importance of these strategies.

Micron’s Dividend Policy and Stock Price

Micron Technology’s dividend policy plays a significant role in shaping investor perception and influencing its stock price. Understanding its dividend history, current payout approach, and potential future adjustments is crucial for assessing the overall investment attractiveness of the company. This section examines the interplay between Micron’s dividend payments and its stock performance.

Micron’s Dividend History and Current Payout Policy

Micron has a history of paying dividends, although the amounts and frequency have varied considerably depending on the company’s financial performance and market conditions. For example, during periods of strong profitability and robust demand for memory chips, Micron has increased its dividend payouts to reward shareholders. Conversely, during periods of industry downturn or financial challenges, the company has either reduced or suspended its dividend payments to conserve cash and reinvest in its business. Currently, Micron maintains a regular dividend payout, with the specific amount announced quarterly and subject to the board’s approval. Investors should refer to Micron’s official investor relations website for the most up-to-date information on its dividend policy.

Influence of Dividend Payments on Investor Returns and Stock Price

Dividend payments directly contribute to investor returns. A consistent and growing dividend stream can attract income-seeking investors, boosting demand for the stock and potentially supporting its price. However, the impact of dividends on stock price is not always straightforward. While a higher dividend might attract investors, it could also reduce the company’s retained earnings available for reinvestment in research and development or expansion, potentially hindering future growth and long-term stock appreciation. The optimal balance between dividend payouts and reinvestment is a crucial strategic decision for Micron. For instance, if a company prioritizes significant capital expenditures for future growth, it might opt for a lower dividend payout, potentially impacting short-term returns but possibly leading to stronger long-term growth.

Potential for Future Dividend Increases or Decreases

The potential for future dividend increases or decreases hinges primarily on Micron’s future financial performance and the overall semiconductor market outlook. Factors such as demand for memory chips, competition from other memory manufacturers, and the global economic climate will significantly influence Micron’s ability to sustain or increase its dividend payouts. Analysts’ predictions and forecasts regarding the semiconductor industry often play a crucial role in shaping investor expectations regarding future dividend actions. For example, a prediction of strong growth in the memory chip market might lead to anticipation of increased dividend payouts by Micron, while a forecast of a downturn could lead to expectations of reduced or suspended dividends. It’s important to note that these are merely predictions and the actual outcome depends on numerous unpredictable factors.

Long-Term Growth Prospects and Stock Price

Micron’s long-term growth prospects are intricately linked to the overall health of the semiconductor industry and its ability to innovate and adapt to evolving technological demands. While the market is cyclical, experiencing periods of boom and bust, Micron’s strategic positioning and technological capabilities offer significant potential for sustained growth. However, several factors could either accelerate or impede this growth trajectory.

Micron’s future success hinges on several key drivers and potential roadblocks. The company’s ability to successfully navigate these challenges will directly influence its stock price performance over the long term. Understanding these factors is crucial for investors assessing the viability of long-term investment in Micron.

Factors Driving Micron’s Future Growth

Several key factors could significantly propel Micron’s future growth. These include the expanding demand for memory and storage solutions across various sectors, Micron’s commitment to research and development leading to technological advancements, and strategic acquisitions and partnerships that enhance its market position. The increasing adoption of artificial intelligence (AI), the Internet of Things (IoT), and 5G technologies are particularly significant drivers of memory demand, directly benefiting Micron’s core business. Furthermore, Micron’s focus on high-value, high-margin products positions it favorably for stronger profitability in the long run.

Factors Hindering Micron’s Future Growth

Despite the positive outlook, several factors could potentially hinder Micron’s growth. These include intense competition from other memory manufacturers, economic downturns impacting overall demand for electronics, geopolitical instability impacting supply chains, and the cyclical nature of the semiconductor industry itself. Fluctuations in commodity prices, particularly for raw materials used in chip manufacturing, also pose a significant risk. Furthermore, the potential for technological disruption, such as the emergence of new memory technologies, could impact Micron’s market share.

Micron Stock Price Forecast

Predicting stock prices with certainty is inherently difficult, as it involves numerous unpredictable variables. However, based on Micron’s long-term growth prospects and considering the factors discussed above, a reasonable forecast can be constructed. This forecast incorporates both optimistic and pessimistic scenarios, reflecting the inherent uncertainty in the semiconductor market.

The following forecast is based on a combination of industry analysis, Micron’s historical performance, and expert opinions, and should not be considered financial advice:

- Optimistic Scenario (Strong Global Growth, Successful Innovation): A steady annual growth rate of 15-20% over the next 5-10 years, leading to a potential stock price range of $150-$200 per share within the next decade. This scenario assumes sustained high demand for memory products driven by technological advancements and a favorable economic climate. This aligns with historical periods of strong growth in the semiconductor industry, such as the boom in the late 1990s and early 2000s.

- Moderate Scenario (Moderate Global Growth, Stable Innovation): A more conservative growth rate of 8-12% annually over the next 5-10 years, resulting in a stock price range of $100-$150 per share within the next decade. This scenario accounts for potential economic slowdowns and increased competition within the memory market, leading to a more tempered growth trajectory. This aligns with periods of moderate growth seen in recent years within the tech sector.

- Pessimistic Scenario (Economic Downturn, Intense Competition): A slower growth rate of 3-7% annually, potentially resulting in a stock price range of $75-$100 per share within the next decade. This scenario assumes a significant economic downturn or a disruptive technological shift impacting Micron’s core business, leading to reduced demand and increased competition pressure. This reflects the potential for market corrections and downturns observed in previous years.

Final Summary

In conclusion, Micron Technology’s stock price is a complex interplay of numerous factors, making it a compelling investment opportunity for those willing to navigate the intricacies of the semiconductor market. While risks exist, particularly concerning supply chain disruptions and intense competition, Micron’s ongoing investments in research and development, coupled with its strong market position, suggest a potentially positive long-term outlook. Careful consideration of these factors, alongside ongoing market analysis, is crucial for informed investment decisions.